How Much Do Trucking Businesses Pay for Fuel? Diesel Stats & How to Save

How much a trucking business pays for fuel depends on many factors: the type of equipment they run, the skill of their drivers, and the lanes and loads they choose, among others.

However, we can estimate the amount of fuel the average trucking business owner may purchase in a year and how much it costs.

How much diesel does trucking consume?

For the trucking industry as a whole, the average class 8 truck drives 62,169 miles in a year.1 Taking the average fuel economy2 of a combination truck – 6.5 in 2020 – that gives you a total consumption of 9,564 gallons of fuel per truck.

In 2021, there were approximately 4.06 million class 8 trucks3 on the road – we can then estimate that trucking consumes somewhere around 38.83 billion gallons of diesel every year.

According to Schneider, truck drivers drive 400-600 miles per day4. Using an average of 260 working days in a year, that works out to 104,000 – 156,000 miles per year. We’ll use the high end of this estimate for owner-operators.

Taking the average fuel economy of 6.5 miles per gallon form above, that means the average owner-operator consumes roughly 24,000 gallons of fuel every year.

With about 350,000 owner-operators out on the road, owner-operators alone consume nearly 8.4 billion gallons of fuel per year.

How much do trucking businesses pay for fuel?

Fuel is one of the biggest variable expenses for a trucking business, sometimes even surpassing driver pay. (A variable expense is one that changes from month to month with the number of miles driven.)

Diesel can account for 25% or more of a trucking business’s operating expenses.

Taking the estimations from above and the US annual average cost of a gallon of diesel in 2023 of $4.215, it costs about $40,264.44 in diesel fuel alone to operate a combination truck.

Since owner-operators drive more, that number may be more like $60k or even $70k for them.

How much do truckers pay in fuel taxes?

Both federal and state governments have taxes on diesel.

As of January 2024, the federal diesel tax stood at 24.4 cents per gallon.6 The average state tax on diesel is 34.76 cents per gallon7.

Seeing that the average owner-operator consumes 15,538 gallons of fuel every year, they pay roughly $9,192.28 in state and federal diesel taxes.

However, state diesel taxes vary widely. If you operate mainly on the West Coast, you may pay much more in state fuel taxes; if you operate in the Southeast, it may be less.

How to save money on fuel as a trucking business owner

Improve fuel efficiency

There are two basic ways to improve fuel efficiency: set up vehicles to use fuel more efficiently and operate vehicles in ways that use less diesel.

Here are a few ways to outfit vehicles for better fuel efficiency:

- Buy trucks with automatic transmissions.

- Close the gap between the power unit and the trailer with trailer gap devices.

- Install auxiliary power units (APUs) and/or bunk heaters to reduce idling.

- Avoid aftermarket devices that block airflow like radiator covers and grille guards.

Driver behavior also greatly impacts fuel economy. Here are some tips:

- Drive the speed limit, or just a bit below.

- Use cruise control whenever you can.

- Avoid quick acceleration and braking, which take more energy.

- Keep tires at optimal pressure.

- Minimize idling.

According to a study by ATRI, the most fuel-efficient drivers improved fuel economy by 35% compared to the least efficient.

Related article: Fuel Savings For Truckers: How To Pay (And Use) Less

Pay Less For Diesel with a Fuel Card

There’s no shortage of fuel card options on the market for truckers. The key is finding a good one.

Here are some things to look out for:

- Acceptance: most fuel cards are only accepted at a limited number of retailers. We recommend getting a card that can be accepted anywhere even if you don’t get as many “discounts.” What good is a 70¢ discount at a major truckstop brand when the Speedway down the road is a dollar cheaper?

- Fees: lots of cards will boast deep discounts on fuel only to charge additional fees that eat away at your expected savings. Find a card with zero fees.

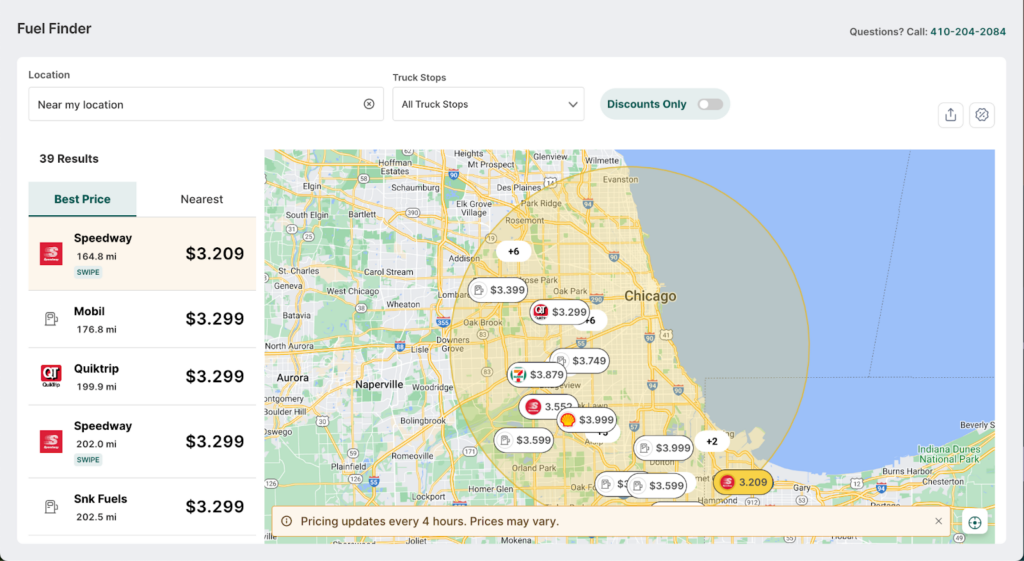

- Fuel finder: find out if the cards you’re considering have a fuel finder – does it show all fueling options or just their network locations? Use an app that will show you all local prices, regardless of their relationship to your fuel card company.

Related article: How to Get a Fuel Card for Your Trucking Business

If you’re shopping for a new fuel card, consider the Bobtail Zero Mastercard®.

We designed our fleet card to serve owner-operators and small fleet managers with no fees and universal acceptance anywhere Mastercard is accepted.

Our fuel finder allows you to get the best possible price on fuel.

With over 6,500 fueling options listed and 900+ partner locations with exclusive fuel savings, we’ve designed our fuel finder to help you get the lowest price at the most convenient location.

Opinions, advice, services, or other information or content expressed or contributed here by customers, users, or others, are those of the respective author(s) or contributor(s) and do not necessarily state or reflect those of The Bancorp Bank, N.A., (“Bank”). Bank is not responsible for the accuracy of any content provided by author(s) or contributor(s).

- Average Annual Vehicle Miles Traveled by Major Vehicle Category, US Department of Energy, https://afdc.energy.gov/data/10309 ↩︎

- Highway Statistics Series, U.S. Department of Transportation Federal Highway Administration, https://www.fhwa.dot.gov/policyinformation/statistics/2020/vm1.cfm ↩︎

- Summarizing US Trucking Statistics, nextBIG Future, https://www.nextbigfuture.com/2023/01/summarizing-us-trucking-statistics.html ↩︎

- How many miles do truckers drive a day on average?, Schneider, https://schneiderjobs.com/blog/how-many-miles-do-truckers-drive ↩︎

- Annual average retail price for diesel fuel in the United States from 1995 to 2023, Statista, https://www.statista.com/statistics/1185300/diesel-fuel-retail-price-annual-average-us ↩︎

- How much tax do we pay on a gallon of gasoline and on a gallon of diesel fuel?, U.S. Energy Information Administration, https://www.eia.gov/tools/faqs/faq.php?id=10&t=5 ↩︎

- 3rd Quarter 2024 Fuel Tax Rates, International Fuel Tax Association Inc., https://www.iftach.org/taxmatrix4/Taxmatrix.php ↩︎

Article By

Keep Learning