Financial Management For Small Trucking Businesses

Financial management allows you to make informed decisions about your trucking business’s finances, identifying areas where you can cut costs or increase revenue. So let’s talk about it.

Leer este artículo en español.

If you’re reading this blog, you run (or have thought about running) your own trucking business. It’s many people’s dream to have a small business doing something they love that supports their family for generations. In fact, the Census Bureau estimates that more than 34,000 businesses started in transportation and warehousing in 2022 alone.

Unfortunately, more than 50% of small businesses won’t last more than 5 years. According to the Bureau of Labor Statistics, “20% of new businesses fail during the first two years of being open, 45% during the first five years, and 65% during the first ten years.”

In the competitive trucking industry, where margins can be thin, the failure rate is even greater. This is why it’s so important to keep a close eye on your company’s finances.

Start With A Business Plan

A business plan is a document that outlines the goals, strategies, and financial projections for the company. It helps to identify the target market, competition, and potential risks.

In the article, “The 6 Questions A Trucking Business Plan Should Answer”, we highlighted the key components of a trucking business plan, including a company overview, market analysis, marketing strategy, operations plan, financial plan, and management structure. The financial plan should include a budget, revenue projections, and cash flow analysis.

Having a business plan is crucial for the success of a trucking company. Remember, this isn’t a plan you have to follow to the letter. It is a living document that should be used as a guide for making strategic decisions and achieving long-term success.

So before asking, “What kind of truck should I buy?”, consult your business plan to determine what needs of the industry your company will serve and let the type of equipment follow.

Calculate Your Cost Per Mile

One of the most important aspects of financial management for small trucking companies is to understand your costs. By calculating your cost per mile, you can determine how much it costs you to operate your trucks and how much revenue you need to generate to make a profit.

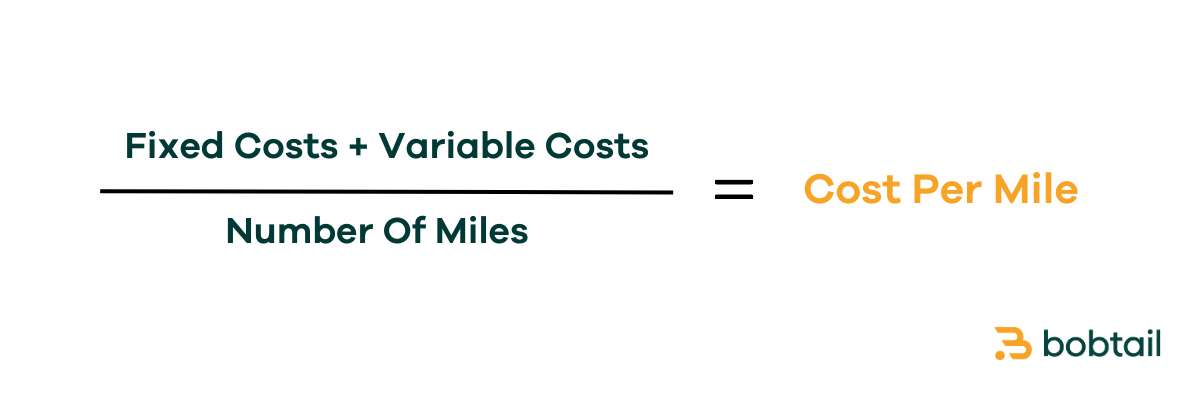

Calculating your cost per mile is a straightforward process that involves adding up all of your expenses and dividing them by the number of miles you drove during a given period.

Here are the steps to follow:

Step 1: Determine Your Fixed Costs

Fixed costs are expenses that are consistent from month to month, no matter how much you drive. These include things like insurance, permits, licenses, and truck loan payments. To determine your total fixed costs, add up all of your monthly expenses that are not related to the number of miles you drive.

Step 2: Determine Your Variable Costs

Variable costs are expenses that vary with the number of miles you drive. These expenses include things like fuel, tolls, maintenance, and repairs. To determine your total variable costs, add up all of your expenses related to driving.

Step 3: Add Your Fixed and Variable Costs

Add your fixed and variable costs to get your total costs. We wrote an entire article about the expenses of a solo owner-operator.

Step 4: Determine the Number of Miles You Drove

Determine the number of miles you drove during the period: this should be an easy output from your ELD. Make sure the time period is the same as the time period of your costs: a week, a month, a quarter, etc.

Step 5: Divide Your Total Costs by the Number of Miles You Drove

Divide your total costs by the number of miles you drove to get your cost per mile. For example, if your total costs were $10,000 and you drove 10,000 miles, your cost per mile would be $1.

Why is Calculating Cost Per Mile Important?

First, calculating your cost per mile allows you to determine how much revenue you need to generate to cover your expenses. You can then set goals around how much profit you want your business to generate and negotiate confidently with brokers and shippers.

Second, it can help you identify areas where you can cut costs. For example, if you notice that your fuel costs are increasing, you may be able to save money by getting a fuel card or optimizing your routes.

Manage Your Business’s Cash Flow

Cash flow is the movement of money in and out of the business, and it is critical for meeting day-to-day expenses, such as fuel, repairs, and salaries. Poor cash flow management can lead to missed payments, late fees, and even bankruptcy.

In the trucking industry, cash flow can be particularly challenging due to the long payment cycles with brokers and high operating costs. Therefore, it is crucial to have a cash flow management strategy that ensures a steady and reliable stream of income.

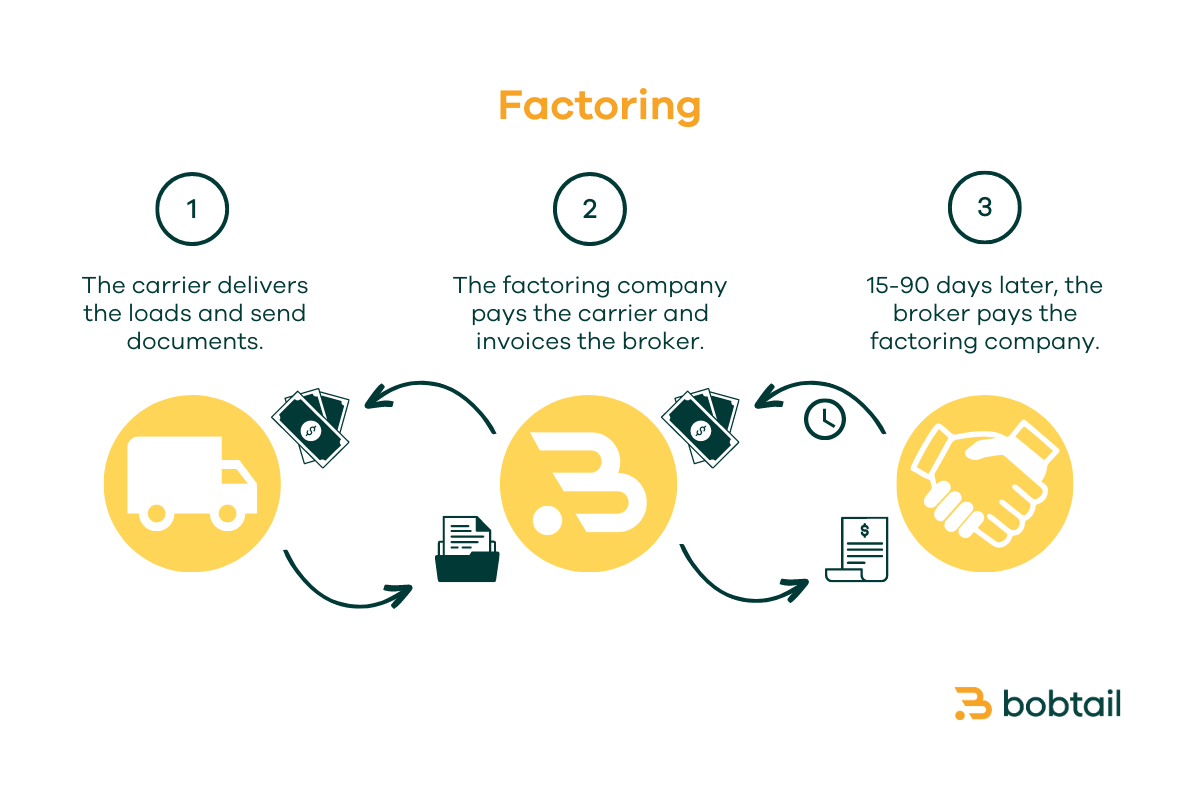

One solution for managing cash flow in the trucking industry is factoring. Factoring is a financial service that allows trucking companies to sell their unpaid invoices to a factoring company at a discount.

The factoring company then pays the trucking company for the amount of the invoice, minus the factoring rate. When the invoice comes due, the factoring company collects the full amount from the broker.

With Bobtail, you can get your money the same or the next day at a competitive factoring rate with no extra fees. You also get access to a dedicated support team and an easy-to-use mobile app for managing all your information.

Click here to sign up to speak with an Account Executive about our factoring service.

Understand The Costs and Benefits Of Every Decision

Upgrading to new equipment can reduce costs over time. However, it’s important to conduct a cost/benefit analysis to determine whether the investment is worthwhile.

A cost/benefit analysis is a process of comparing the expected costs of a decision with the expected benefits. In the case of buying new equipment, the costs would include the purchase price, financing costs, maintenance costs, and disposal costs. The benefits would include increased efficiency, improved reliability, and reduced downtime.

To conduct a cost/benefit analysis, you need to gather the relevant data: the estimated costs and savings over the life of the equipment. Be sure to consider the risks and uncertainties associated with the investment, such as changes in the market and technology.

If the expected benefits exceed the expected costs, then the investment is likely to be profitable. However, if the expected costs exceed the expected benefits, then you may want to consider alternative options, such as leasing or renting equipment, or delaying the investment until the costs and benefits are more favorable.

A cost/benefit analysis can help you make the best decision for your business and avoid costly mistakes.

Other Financial Management Tips

In addition to calculating your cost per mile, several other financial management tips can help small trucking companies stay profitable. Here are some tips to consider:

Keep Accurate Records

Make sure to track all of your expenses and revenue, including fuel receipts, maintenance records, and invoices.

Pay Yourself

You deserve to be compensated for your hard work and the risks you take. You will sacrifice time, energy, and personal finances to get their businesses off the ground, and it is only fair that you get paid for your efforts.

Paying yourself a modest wage also ensures that you have a stable income to cover your personal expenses and financial obligations, which can help reduce stress and increase your overall well-being.

Open A Business Bank Account

Keeping your business and personal finances separated is important for many reasons, regardless of whether you are a solo trucker or managing a fleet. The benefits of having a business bank account include better financial management and easier tax filing.

In our article “How To Open A Bank Account For Your Trucking Company”, we provide guidance on how to open one and explain the potential risks and consequences of mixing personal and business finances.

Get a Fuel Card

In our blog, “What Is A Fuel Card? And How To Choose One”, we explained what a fuel card is and why it’s beneficial for trucking companies. Fuel cards can help truckers save money on fuel, improve cash flow, and track expenses.

Some features to look for when choosing a fuel card include discounts, network coverage, security, customer service, and reporting capabilities. Getting a fuel card is only one of many things you can do to reduce your fuel spend.

Article By

Keep Learning